China’s Augmented Reality (AR) and Virtual Reality (VR) markets have undergone significant changes over the past few years.

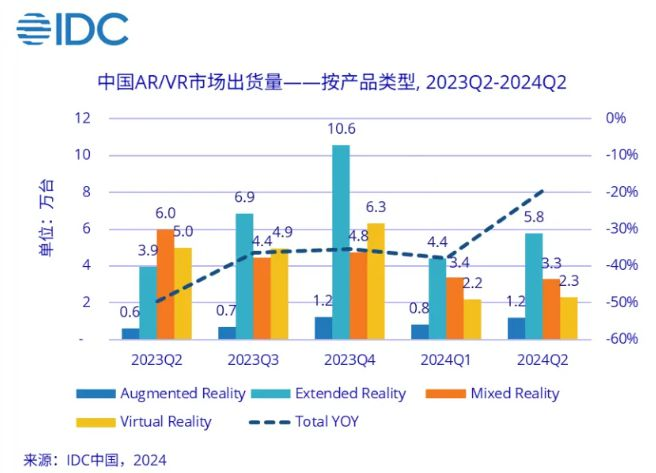

According to the most recent report by the International Data Corporation (IDC), the first half of 2024 saw the shipment of 233,000 AR and VR headsets in China, reflecting a year-on-year decline of 29.1%.

While this figure highlights some challenges, it also underscores areas of growth, particularly in AR and Extended Reality (ER) markets. This article will dive deeper into these trends, analyze key drivers and market challenges, and explore future expectations in the AR/VR industry in China.

### Overview of 2024 H1 Shipments

The IDC report reveals mixed results across various XR (Extended Reality) categories, including AR, VR, ER, and Mixed Reality (MR) headsets:

– **AR headsets:** 20,000 units, an impressive increase of 101.7% YoY.

– **ER headsets:** 102,000 units, representing a 75.4% increase YoY.

– **MR headsets:** 66,000 units, a 49.3% decrease YoY.

– **VR headsets:** 45,000 units, experiencing a steep 65.5% drop YoY.

The standout takeaway here is the strong growth in AR and ER headset shipments, while VR and MR categories saw significant declines. This signals a shift in consumer and business focus, as new technologies such as AR glasses and ER platforms grow in prominence.

### AR/ER Growth: Key Drivers

#### 1. **Consumer Demand for AR and ER Devices**

AR and ER technology have emerged as the leading drivers of growth within the XR ecosystem. AR technology is primarily used in applications such as gaming, education, healthcare, and remote assistance. IDC predicts that AR and ER markets will see a 21.2% YoY increase, with a total shipment of 317,000 units in 2024. This growth can be attributed to several factors:

– **Immersive Experiences in Consumer Electronics:** The increasing demand for AR-enabled gaming, social media applications, and content consumption has fueled consumer interest in AR and ER headsets. Products like smart glasses with AR functionality are gaining momentum, thanks to their user-friendly interface and the potential to overlay information in the real world.

– **Advances in AI and Computer Vision:** AI-driven advancements, such as object recognition, gesture-based control, and voice interaction, are enhancing the usability of AR/ER glasses. This has led to improved user experiences and more practical applications for both enterprises and consumers.

– **Overseas Brands Entering the Chinese Market:** The entrance of international players like Viture, a leader in the AR smart glasses space, into the Chinese market could disrupt the competitive landscape. Their innovative offerings and strong overseas performance are expected to shake up the ER market, leading to a redefinition of the competitive environment in China.

#### 2. **Optical Display and SLAM Technology Enhancements**

A significant technological advancement within the AR space is the integration of **optical displays** and **Simultaneous Localization and Mapping (SLAM)** technologies. These innovations allow AR glasses to map real-world environments in real time and seamlessly overlay virtual objects. As AR glasses continue to evolve, these improvements will push AR products beyond simple viewing experiences to more advanced interaction-based applications, such as:

– **Navigation and Mapping Services:** Real-time AR-based navigation overlays on streets, creating real-time assistance for users in outdoor environments.

– **Industrial and Training Applications:** AR headsets are increasingly used for hands-free training, maintenance, and repairs in industries like manufacturing, aerospace, and healthcare.

### VR and MR Markets: A Slowdown but Pockets of Growth

#### 1. **Declining Shipments and Market Saturation**

The VR and MR markets experienced a downturn in the first half of 2024. VR shipments saw a significant drop, down by 65.5% YoY, while MR devices dropped 49.3%. IDC attributes this to several reasons, including market saturation, slower-than-expected technological advancements, and the shifting focus toward more versatile AR and ER technologies.

One major challenge for VR and MR markets is the slow pace of hardware and content innovation. While there is still substantial interest in VR for gaming and entertainment, the lack of fresh and compelling content has caused a plateau in consumer interest.

#### 2. **Growth in Large-Space VR Projects**

Despite the overall decline in VR and MR headset shipments, there is one area where VR is showing signs of strength: **large-space VR projects**. These projects, which are often used in entertainment and cultural industries (e.g., virtual museums, historical tours, and interactive exhibitions), have seen explosive growth. The increase is driven by the collaboration of content developers, hardware manufacturers, and local government policies that promote immersive tourism and cultural experiences.

The use of VR headsets in large-space environments, where users can move freely and interact with virtual objects, has become a popular feature in tourist destinations across China. In these settings, VR devices provide users with deeply immersive historical, cultural, and exploration experiences.

#### 3. **Meta’s Push into AR with Vision Pro and MR**

The IDC report highlights that Meta, a key player in the VR space, has begun expanding its focus to AR, particularly with its Vision Pro headset. Meta’s strategy aligns with the broader trend of technology convergence, where AR and VR are expected to merge into a more unified **Extended Reality (XR)** ecosystem.

By integrating AR into their product line, Meta aims to blur the lines between virtual and augmented experiences. The Vision Pro, in particular, has been positioned to deliver **Mixed Reality (MR) outdoor experiences**, which will likely open new opportunities for MR use cases beyond the confines of indoor settings. This could breathe new life into the MR market, which has otherwise struggled in recent quarters.

### Future Outlook: 2024 and Beyond

Looking ahead, the IDC report forecasts that China’s AR and VR markets will continue to experience divergence. By the end of 2024, total AR/VR shipments are expected to reach 602,000 units, a 17.1% YoY decline compared to 2023. Despite this overall decline, certain segments such as AR and ER will continue to experience positive growth.

#### 1. **Emergence of AI Glasses and Smartphone Manufacturers**

As AI glasses begin to rise in prominence, many smartphone manufacturers are venturing into the AR space. These companies are investing heavily in the development of AR products equipped with optical screens and enhanced AI capabilities. By the end of 2024 and into 2025, several smartphone makers are expected to launch their first-generation AR glasses.

These AI-powered AR glasses are expected to enhance user experiences by leveraging mobile connectivity, making AR technology more accessible to everyday consumers. From real-time translations to object identification and smart navigation, the possibilities are extensive.

#### 2. **The Convergence of AR and VR into XR Ecosystems**

As the technologies of AR, VR, and MR continue to evolve, there is a growing consensus that these individual segments will eventually converge into a unified XR ecosystem. This convergence will create new opportunities for the development of hybrid headsets capable of seamlessly switching between virtual and augmented experiences.

The integration of SLAM technology, along with advances in cloud computing and 5G, will enable XR devices to deliver highly immersive, low-latency experiences in both virtual and real-world environments. IDC anticipates that this convergence will drive new hardware and software innovations, creating a new generation of XR products by 2025 and beyond.

—

### Conclusion

The AR and VR markets in China are undergoing a significant transition in 2024. While overall headset shipments are down, the rapid growth of AR and ER products highlights the continued evolution of immersive technologies. Advances in AI, optical displays, and SLAM technology are propelling AR products to the forefront of this transition, while VR and MR face challenges due to market saturation and limited content innovation.

Looking forward, the convergence of AR and VR into a unified XR ecosystem will shape the future of the industry. As international players like Meta expand into the AR space and smartphone manufacturers enter the fray with AI-powered glasses, the XR market will undoubtedly become more competitive and innovative. By 2025, we can expect to see an exciting new generation of XR products that blur the boundaries between our digital and physical worlds.

(Article reproduced from https://cdn.idc.com/getdoc.jsp?containerId=prCHC52608924)